Meta Platforms Inc., the parent company of Facebook, Instagram, and WhatsApp, has remained a significant player in the stock market. Over the years, its stock price has seen fluctuations driven by product launches, earnings reports, global market trends, and more recently, its pivot to the metaverse. If you’re wondering whether Meta’s stock deserves a place in your portfolio, this post will break down key elements that influence its price and help you make an informed decision.

Analyzing Meta’s Recent Stock Performance

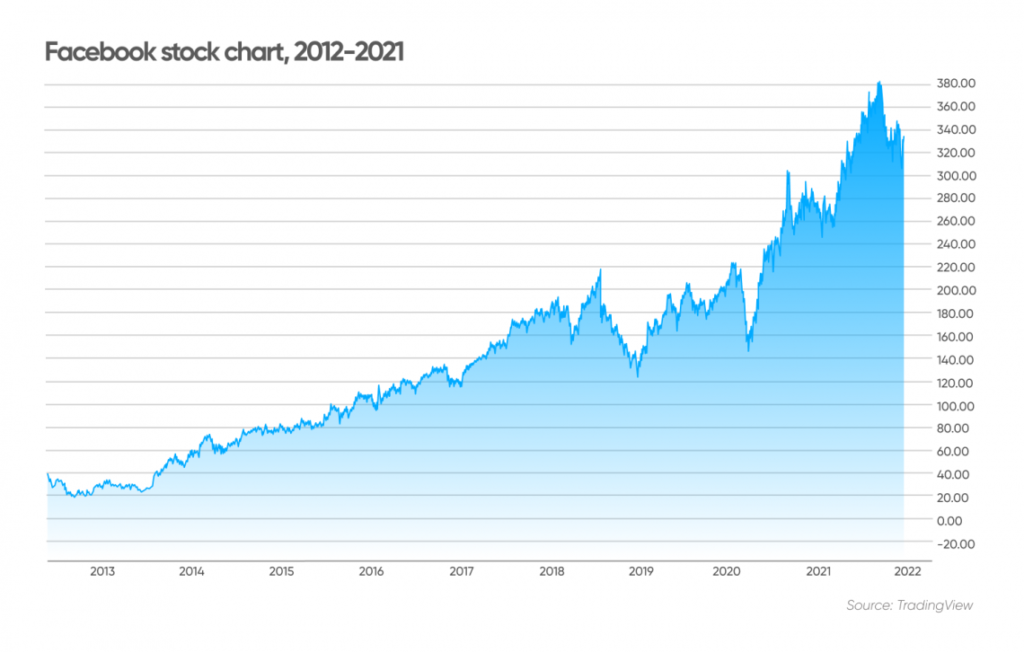

To better understand Meta’s stock price trends, it’s crucial to look at its recent performance in the market. Below is a snapshot of important metrics.

Table of Contents

Meta Stock Price Snapshot

| Date | Opening Price | Closing Price | 52-Week High | 52-Week Low |

| Market Cap (Approx.) |

| Jan 1, 2023 | $120.34 | $125.48 | $312.56 | $88.09 | $810 Billion |

| June 1, 2023 | $235.64 | $243.02 | $312.56 | $88.09 | $900 Billion |

| Oct 1, 2023 | $302.18 | $310.85 | $312.56 | $88.09 | $1.02 Trillion |

From this data, it’s clear that Meta has experienced considerable growth in 2023. The stock has recovered from its lows and is floating near its 52-week high—a promising sign for existing shareholders or potential investors.

Key Influences on Meta’s Stock Price

1. Earnings Reports and Revenue Streams

Meta’s earnings reports remain a major driver of its stock price. The company generates its primary revenue from digital advertising across its vast platforms, including Facebook and Instagram. Recently, the impact of Apple’s App Tracking Transparency (ATT) has stabilized, allowing advertisers to better optimize campaigns on Meta platforms, which positively affects stock prices.

The company’s Q3 2023 earnings report revealed a strong rebound, with ad revenue growing 17% year over year, significantly boosting investor confidence.

2. Metaverse Investments

Meta’s pivot to the metaverse has captured attention (and criticism). The company has invested billions into its Reality Labs division, which focuses on augmented reality (AR) and virtual reality (VR). While this move increased R&D expenses significantly, Meta is positioning itself as a leader in AR/VR technologies.

For now, these upfront investments haven’t yielded direct profits, which has led to mixed reactions from analysts. Investors should weigh the risk of these heavy tech-driven investments carefully.

3. Global Market Trends and Macroeconomic Conditions

Stocks in the tech sector, including Meta, are sensitive to global market trends such as inflation, interest rate hikes, and changes in monetary policies. For instance, periods of low interest rates often favor high-growth companies like Meta. On the other hand, broader economic slowdowns can reduce advertiser budgets, impacting Meta’s bottom line.

Why Meta Might Be a Stock to Watch

Meta isn’t just a social media company anymore. Its ventures into e-commerce, AI, and the metaverse have diversified its revenue streams, creating long-term growth opportunities. Here are some reasons why investors are optimistic about Meta’s stock price in 2024 and beyond.

Diverse Revenue Streams

From ad revenue and e-commerce tools for small businesses to platform monetization for creators, Meta has created a robust network of income streams. This diversification reduces financial risks rooted in any single source of revenue.

Strength in AI Technology

Meta’s advancements in AI technology power everything from personalized ad targeting to recommendation algorithms. These AI tools ensure that users spend more time on Meta’s platforms, which further enhances the platform’s ad revenue.

Share Buybacks

Meta has also actively engaged in share buybacks. By reducing the number of outstanding shares, buybacks elevate the earnings per share (EPS) metric, making the stock more attractive to investors.

Risks to Consider Before Investing in Meta

Although there are many reasons to be optimistic, potential investors should also consider some risks associated with Meta stock.

- Metaverse Spending

While Meta’s metaverse ambitions are ambitious, there’s still uncertainty about when (or if) these investments will pay off. It’s a long-term play, meaning short-term profits could be sacrificed along the way.

- Shifts in Digital Advertising

The majority of Meta’s revenue still comes from digital advertising, which leaves the company vulnerable to advertising industry changes, such as privacy policies implemented by tech giants like Apple and Google. For instance, a significant industry shift to alternative platforms could impact Meta’s revenue.

- Regulatory Pressures

Meta continues to face scrutiny from regulators worldwide. Antitrust concerns, privacy laws, and content moderation policies could lead to government actions that might affect profitability.

FAQs About Meta Stock Price

1. What’s driving the recent increase in Meta’s stock price?

The recent surge can be attributed to strong earnings performance, growth in digital ad revenue, and increased investor optimism in Meta’s long-term technological projects, such as AI and the metaverse.

2. Is Meta a good long-term investment?

Meta’s strong revenue growth, commitment to technology innovation, and diversified income streams suggest it could be a good long-term investment. However, risks like regulatory pressure and high investment costs in the metaverse mean potential investors should proceed carefully.

3. How does Meta compare with other tech stocks?

Meta has consistently outperformed many of its peers in terms of ad revenue. Additionally, unlike some tech competitors, it has made significant strides in exploring futuristic markets like AR/VR and the metaverse.

4. Does Meta pay dividends?

No, Meta does not currently pay dividends. The company reinvests profits into growth and innovation initiatives.

5. What should new investors watch for when considering Meta stock?

Keep an eye on key factors like quarterly earnings reports, developments in the metaverse space, regulatory changes, and overall macroeconomic conditions. These will heavily affect the stock price trajectory.

What’s Next for Meta?

Meta’s stock price reflects its dynamic business approach. With significant advancements in advertising, cutting-edge technologies like AI, and bold investments into the metaverse, the company is building future-proof revenue streams.

If you’re considering investing, now might be the time to closely monitor Meta’s financial performance and strategies. Keeping an eye on risks like market trends and regulatory factors is just as important. Meta’s future holds growth, innovation, and the promise of reshaping the digital economy. Whether or not it fits your portfolio depends on your risk tolerance and long-term investment goals.